Qbi Deduction 2025

Qbi Deduction 2025 - Qualified Business Deduction QBI Calculator 2023 2025, The qualified business income (qbi) deduction is available to eligible individuals through 2025. And with the new financial year beginning soon, taxpayers would again be required. The QBI Deduction What Real Estate Businesses Need to Know Rosenberg, For instance, if your monthly basic salary is rs. The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi.

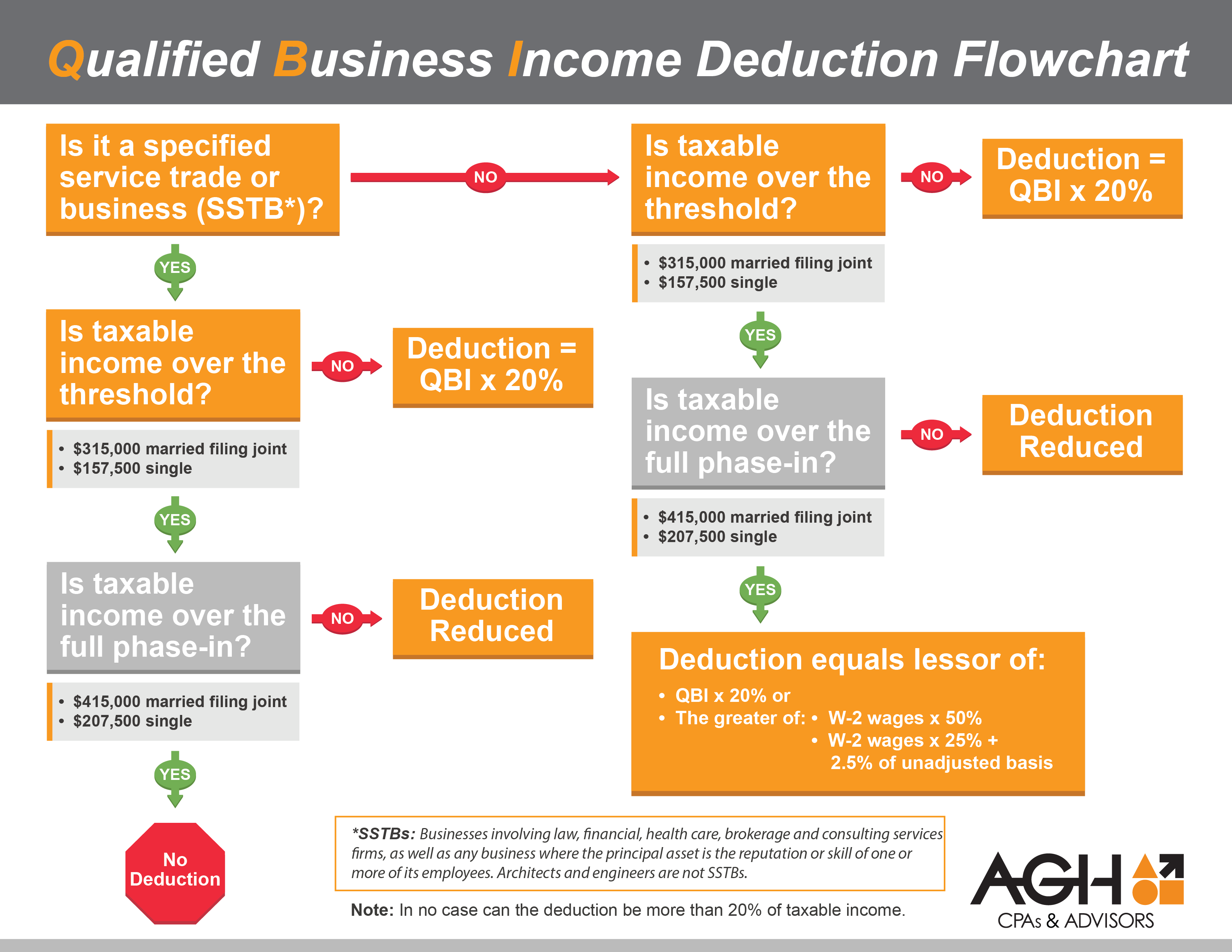

Qualified Business Deduction QBI Calculator 2023 2025, The qualified business income (qbi) deduction is available to eligible individuals through 2025. And with the new financial year beginning soon, taxpayers would again be required.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy, After that, it’s scheduled to disappear, unless congress passes. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

What Is the Qualified Business Deduction (QBI), and Can You, For more information on the qbi deduction, read the relevant irs article on qbi deductions or speak to a tax professional. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc., The qbi deduction is available to most people. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

After that, it’s scheduled to disappear, unless congress passes.

Jennifer Lopez Photos 2025. Ben affleck and jennifer lopez at the 81st golden globe awards […]

Nca Holiday Classic 2025 Results. Welcome to the 2025 college classic national championship! Milesplits official […]

Qualified Business (QBI) Deduction, The qualified business income (qbi) deduction is a tax break that’s been given to certain business. After that, it’s scheduled to disappear, unless congress passes.

How to calculate a qualified business income deduction.

Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

What Is The Deduction For Qualified Business businesser, Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains. The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.